These days, I have introduced a way to create assets for innovative, empathic people. I call it a super-long-term investment. Today, I will wrap up and close this topic.

How to create more assets

Sometimes, we want to create more assets to secure safety in the future. We cannot help but worry about the future if we are highly empathic. Securing enough assets gives us peace of mind for the future.

Assets are the things that are affordable now and will bring us high value in the future. In other words, creating assets is one of the preparations for the future.

However, we sometimes don’t know how to create assets, especially if we have a strange personality. It often prevents us from doing things the same way as our surroundings. For example, we might be unable to work as a hired employee. We might not like socializing.

In other words, we want an efficient way that suits our personalities to create assets. We can use our nature as a weakness or a strength. We can prepare for the future. We can act differently from those around us. We can judge for ourselves.

The super-long-term investment could be an efficient way for innovative, empathic people. Today, I will summarize that way of thinking. This wisdom might help us secure safety for our futures.

The four types of personalities

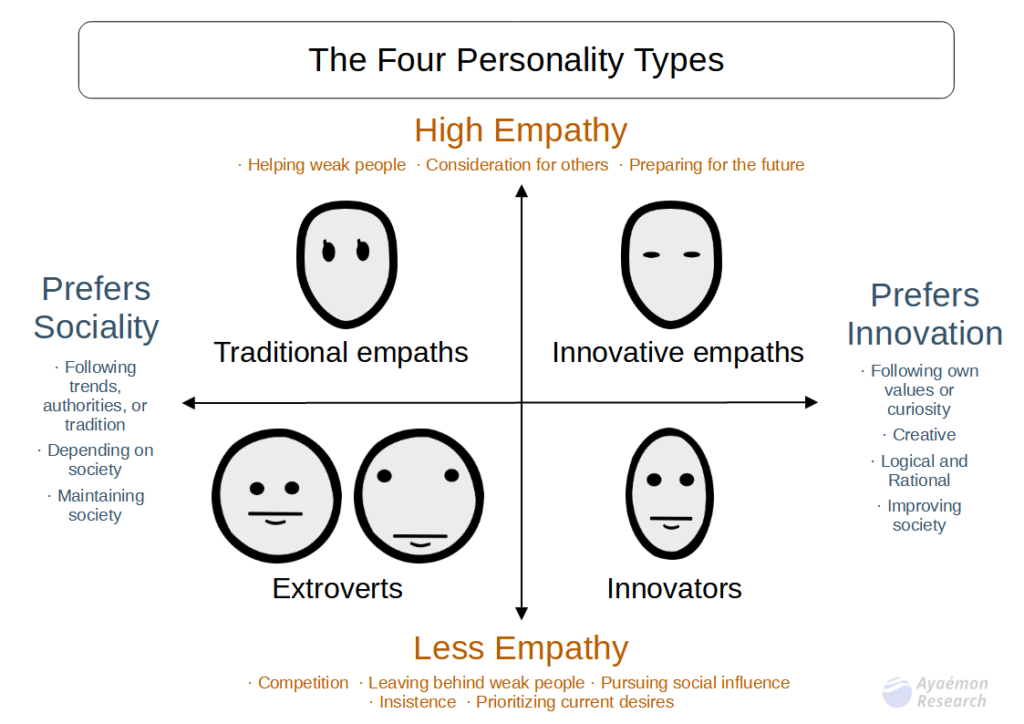

To explain it, I will introduce the four types of personalities that I frequently use, as shown in the following image:

An explanation of each personality

We classify our personalities into four types, as follows:

- Extroverts: They are the least suitable for investment. They can neither worry about the future nor understand the concept of the market cycle. Working in society might suit them better than investing.

- Traditional empaths: They can worry about the future and have the patience to wait. However, they can neither detect the change in the market cycle nor judge for themselves. That causes their losses when the market crashes.

- Innovative empaths: They are the most suitable for investment. They can understand the logic of the market cycle and wait for the best time. In addition, they can use their money for future safety and be satisfied with the safety outlook for the future, even if they are frugal. Investment might suit them better than working in society.

- Innovators: They can understand the market logic. However, they cannot wait. That causes them extreme profits and losses at any time, like gambling.

Perhaps this blog’s readers tend to be innovative empaths, so assume we are innovative empaths in this article.

Four steps of the super-long-term investment

Let’s see the steps of my super-long-term investment. Although I will use the example of the financial market, we could apply it to many asset creations.

We can create assets with the following steps:

- Find an asset that changes in value with time

- Divide into seasons when value changes

- Find other products from another season

- Buy low, sell high (or buy low and keep getting dividends)

Let me explain each step.

1. Find an asset that changes in value with time

First, we focus on things that change in value with time. They could be assets if we get them when they are cheap and consume or sell them when they are expensive.

For example, we can buy discounted Christmas goods just after Christmas. Then, we consume or sell them next Christmas.

Another example is the orange trees in our gardens. Once we get it cheaply and plant it, we can receive fruits as dividends every winter, even without any care.

2. Divide into seasons when value changes

Second, we divide into seasons when value changes.

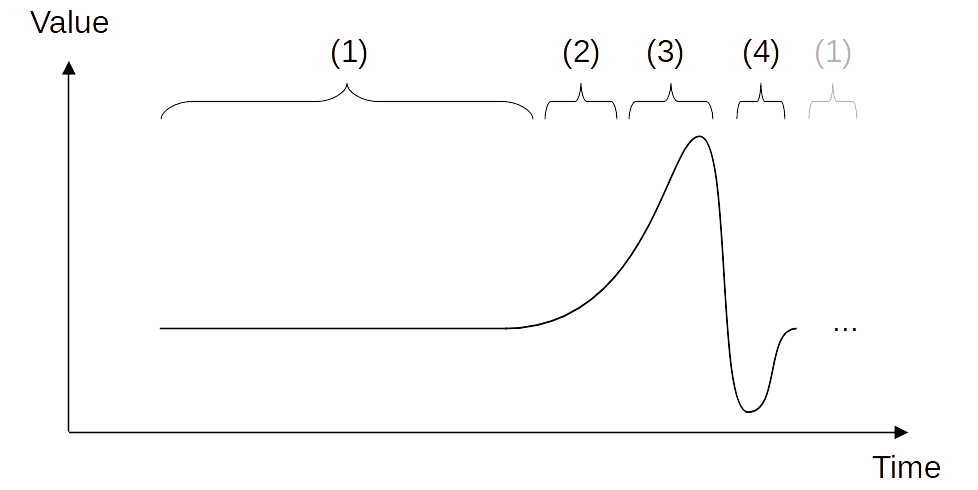

There is a cycle in which social value changes with the seasons. Although there are many patterns, the following image is an example:

This concept of the market cycle tells us when to buy or sell. In other words, we never deal with things we don’t know the cycle of.

3. Find other products from another season

Third, we find other products from another season. There should be other seasonal products. If we deal with Christmas goods, there could be other seasonal goods, such as spring, summer, or autumn. They give us more frequent opportunities.

In my case, I sorted out the financial assets into four seasons, as follows:

- Spring: Just after the market collapse. The prices of commodities, such as gold, silver, crude, or wheat, soar. People value the real thing rather than organizations or technologies in this period.

- Summer: After settling the confusion of the market collapse. The market gets stable. The price of social foundations, such as bonds, social infrastructure industries, or the stocks of energetic emerging countries, continuously rises. (The 60/40 portfolio would work in this period.)

- Autumn: When the bubble economy. The market is heating up. The prices of high-leverage assets or leading company stocks soar. The housing market and the most trending tech companies are examples.

- Winter: The time of market crashes. Cash is the king during this period.

If we invest in the financial market, one big cycle could be about 8 to 10 years. The shift between economic boom and recession creates those seasons.

It means I change my portfolio every 2 to 3 years. In other words, I don’t change my portfolio so often. That is why I call this method the super-long-term investment.

4. Buy low, sell high (or buy low and get dividends)

Finally, we deal with assets based on our seasonal logic. We can choose two tactics, as follows:

- (Tactic 1) Buying it when it is cheapest and holding it for a long time. It tends to suit us if we keep it and get dividends.

- (Tactic 2) Buying it before the soaring season. It tends to work well if we don’t get dividends.

Perhaps combining them performs better.

Warren Buffett prefers tactic 1. Perhaps this is because he likes dividends. On the other hand, Jim Rogers likes tactic 2 because he deals with various assets.

I am using tactic 2 because I don’t want to limit my market to the stock market. That style gives me more safety. That is why I like Jim Rogers’ style.

The ideal personality: innovative mind with empathy

Innovative empaths are the best for super-long-term investment, in my opinion. To put it into practice, we must have both logical sense and the mental power to wait.

In other words, this method is too boring, except for innovative empaths. Although we must keep paying attention to market changes, we don’t deal so often. After we build our logic, there is nothing to do most of the time. Sometimes, it is for several years. The super-long-term investment is boring.

Other personalities cannot imitate us. Extroverts and innovators cannot be patient with boredom. Extroverts and traditional empaths cannot detect market change.

On the other hand, it suits innovative empaths because they are sensitive to the risk of market changes. We cannot help but worry. We worry about when to sell, even if the prices go up! That makes us keep focusing without getting bored.

In addition, we can meditate. Meditation gives us the ability to wait comfortably. In addition, we seldom make losses because we can buy when it is the cheapest or before the price rises. We worry about when to take profits. It is a healthy worry.

This method is comfortable for those who worry too much.

My prospect

In my opinion, now may be before the market crashes in the super-long term. It might occur next year, in 2025, although it could be delayed. I am preparing for it.

Commodities, such as gold and silver, had already started rising, so I stopped buying them. I don’t buy assets that have already begun to go up.

Conclusion

The super-long-term investment could be an efficient way to create assets for innovative empaths.

We can use our personality as a talent. Worrying too much about the future is a talent with this method.

This knowledge might help us secure safety in the future.

Thank you for reading this article. I hope to see you in the next one.