Recently, I have been interested in predicting the future. Although the future is vague in many areas, we can anticipate certain ones, such as crowd movements. Today, I will introduce how to predict the future by knowing how crowds react.

How to find an opportunity

Sometimes, we want an opportunity to change our lives, especially in a stressful environment. We might want to escape from our exhausting lives and wish for a more peaceful one.

One opportunity would be to take advantage of future change. Many people assume the same situation will continue. However, there are several environments that change in every era. If we can predict them and prepare appropriately, we can make profits, which gives us the resources to change.

However, we sometimes know neither in which areas we forecast nor how to find the future change that is not happening yet. Many things are unpredictable. For example, I don’t know my future and how it unfolds.

Although many futures are vague, some are not hard to predict. What the crowd decides is one of the predictable areas. We can take advantage of it.

Investment is a typical example. Crowds determine the prices of things. There are often cycles that we can foresee and prepare for. That could give us abundance.

Today, I will introduce how to predict the future by telling how crowds react.

Cycles caused by the reaction of crowds

Crowd reactions are one of the most predictable areas because people remember more recent events. In other words, many people forget the distant past and judge by recent experiences.

That tendency creates cycles. We might sometimes hear that history repeats itself. That is because we let go of the distant past and place more importance on recent experiences. That would be natural for most lives.

Of course, the more critical events or failures we experience, the more we remember them. However, people often forget the events that didn’t matter, even wars, the decline of the state, recessions, or the financial market collapse. In other words, humans are gradually improving while repeating similar mistakes.

We can take advantage of those historical cycles. We don’t have to get involved in those repetitive failures. Making profits with it will be one of the social contributions. We can reduce the negative impact on society and get more wealthy.

Patterns of cycles

There are many patterns of cycles. Let me introduce several typical patterns below.

One way to find the cycle is noticing the words that the majority says, “If things continue as they are, the future will be like this.”

If the majority starts saying that, it would likely be a tipping point.

1) Soaring value

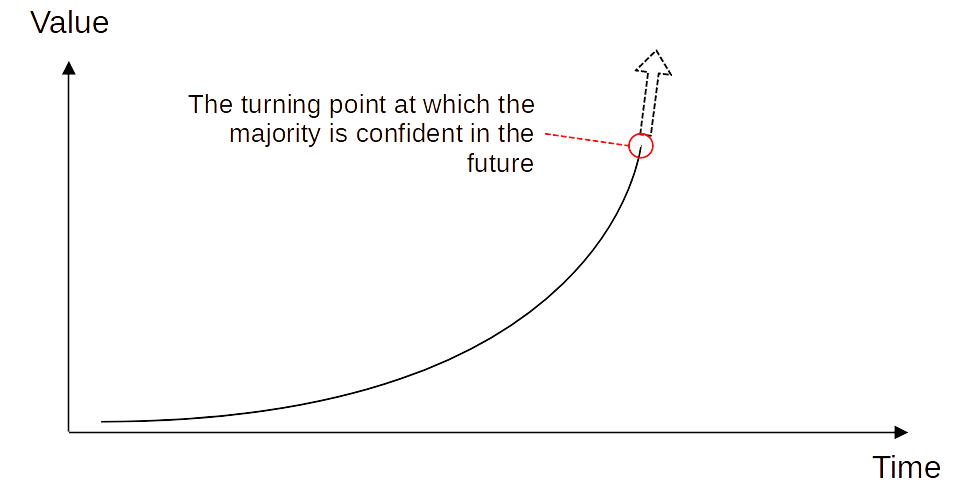

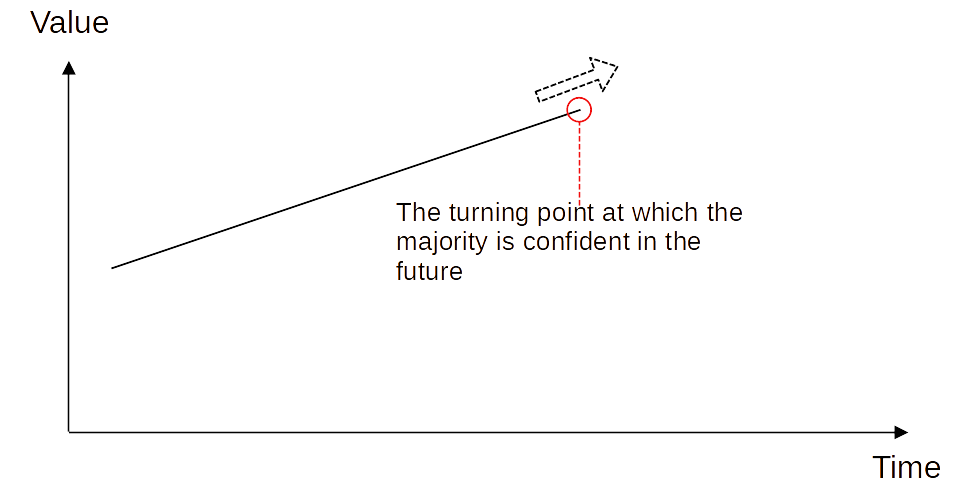

For example, suppose the value of something soaring exponentially, as shown in the following image:

We can frequently see it in trending areas or social alerts, such as the price of trending products, the sales of popular new companies, the growth of the internet, the graph of environmental pollution, human population growth or decline, or climate change.

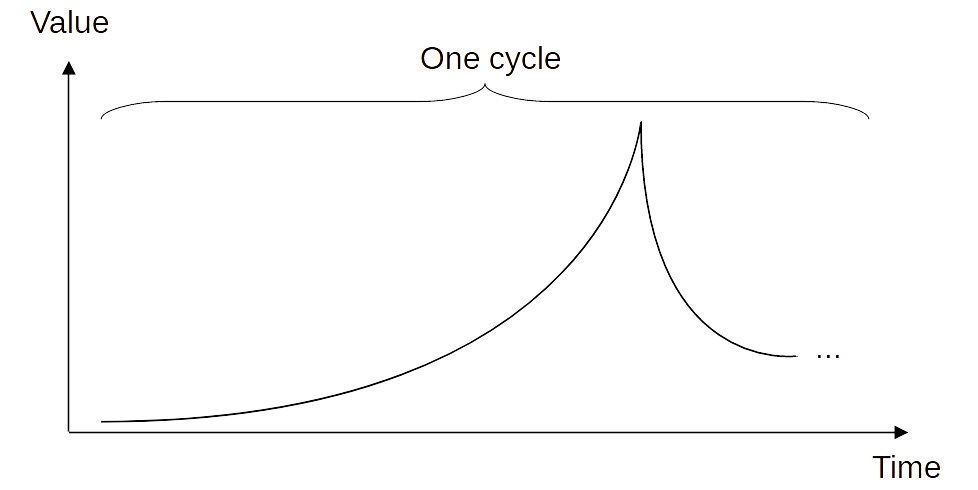

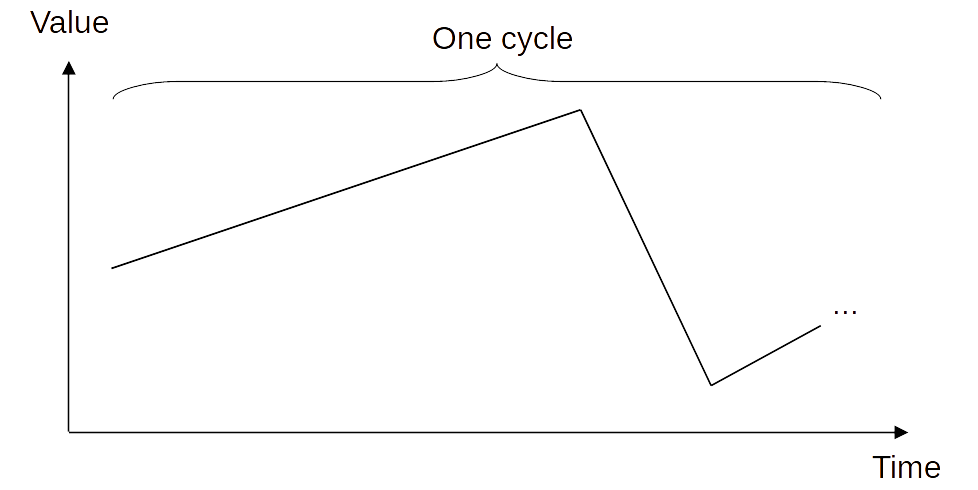

At this point, many people can anticipate the value will explode soon. That brings many people worries or greed. The reaction of the majority creates a backlash in the area where the crowd determines the value, like the image shown below:

The cycle caused by fear and greed

If we think about it calmly, we will soon understand that it will never explode until infinite.

For example, when the amount of information on the internet leaped around 10 years ago, some people said along with the graph above, “The amount of information will explode to infinity until 2020, and humanity will be devastated by too much information!”

If we think about it calmly, we will soon understand it will never happen because information requires storage space. Storage space is physically limited. We can predict the acceleration will slow down at some point.

However, many people cannot think of that because they can only perceive the recent past.

The economic bubble is the same. If the price of the S&P500, one of the stock price indexes, keeps rising, many people start to say, “Just by buying the S&P500, you can become rich!” When the majority believes it, it will be a tipping point.

Then, worries and greed create a backlash in the area where the crowd determines the value, such as the values of related companies or the stock prices.

That creates one cycle.

2) Plunging value

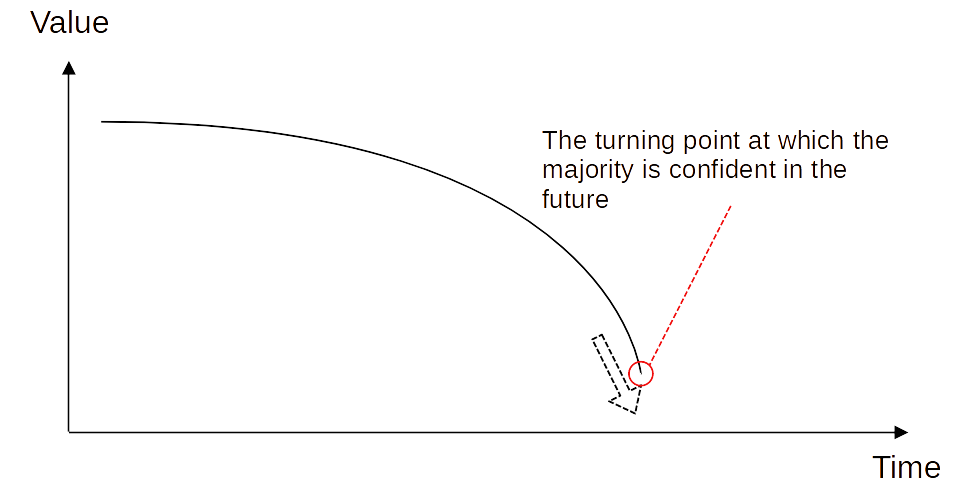

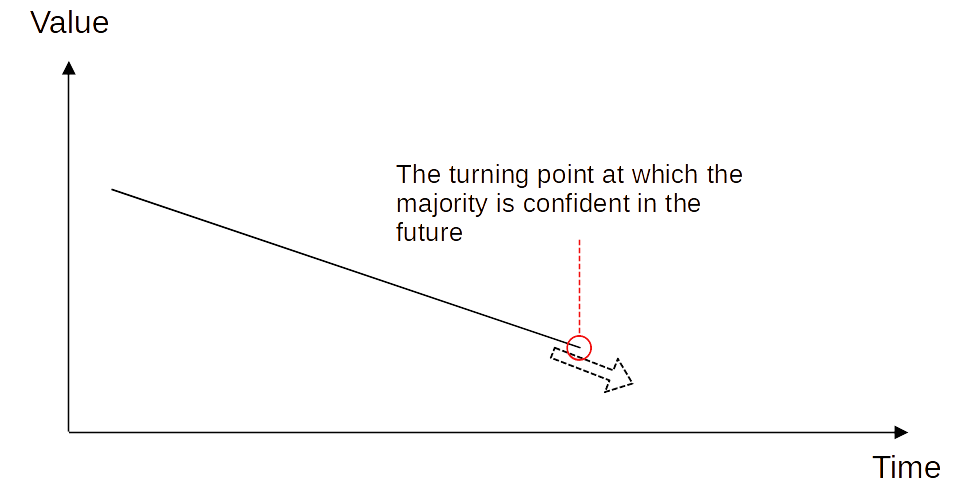

Similarly, something can drop sharply, as shown in the following image:

At this point, many people are afraid of becoming complete worthlessness.

That reaction creates one cycle.

3) Growing value

Sometimes, it can be a continuous rise.

This often would be like below:

In this case, reaching a certain level of value or time often triggers changes.

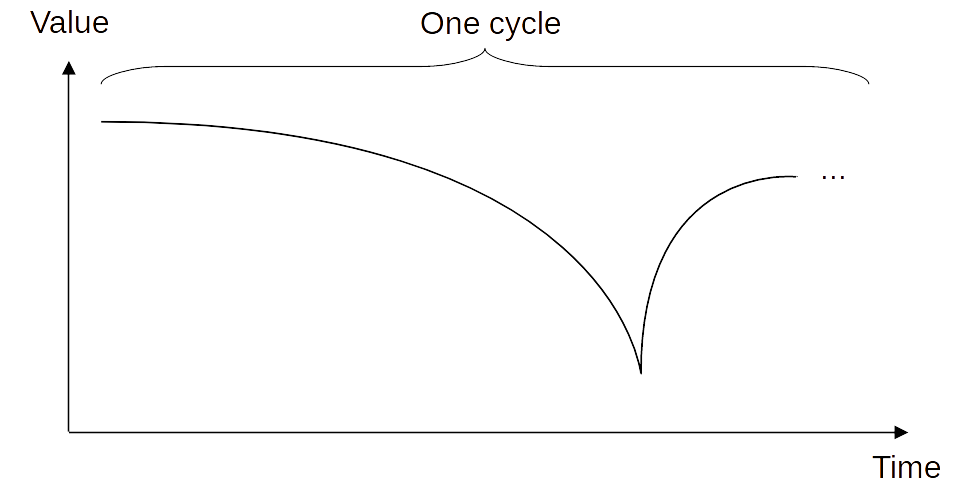

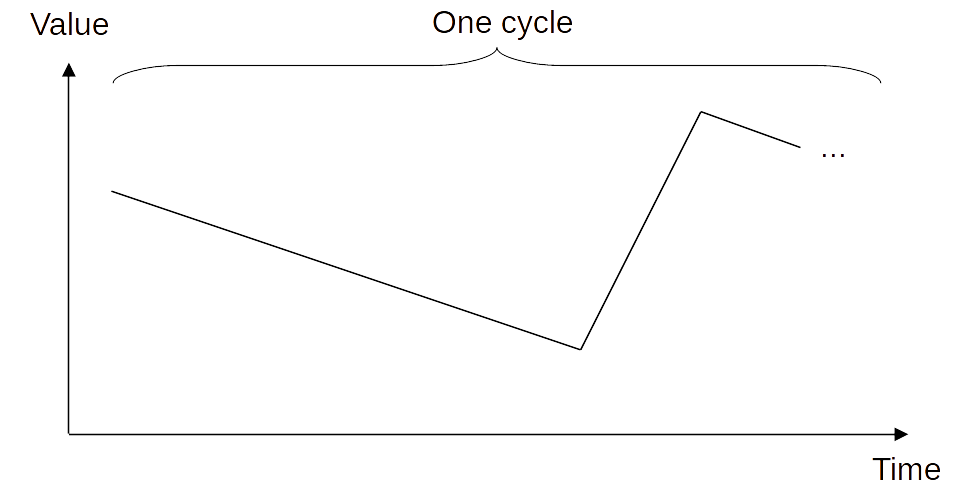

4) Declining value

The reverse pattern could also occur.

That creates a cycle.

Of course, they are examples. There could be other patterns, as I introduced in an earlier post (this article).

Predicting movements by duality

However, accurately predicting the future is usually difficult only with the concept of a cycle due to its duality. It means several factors other than a cycle affect the result.

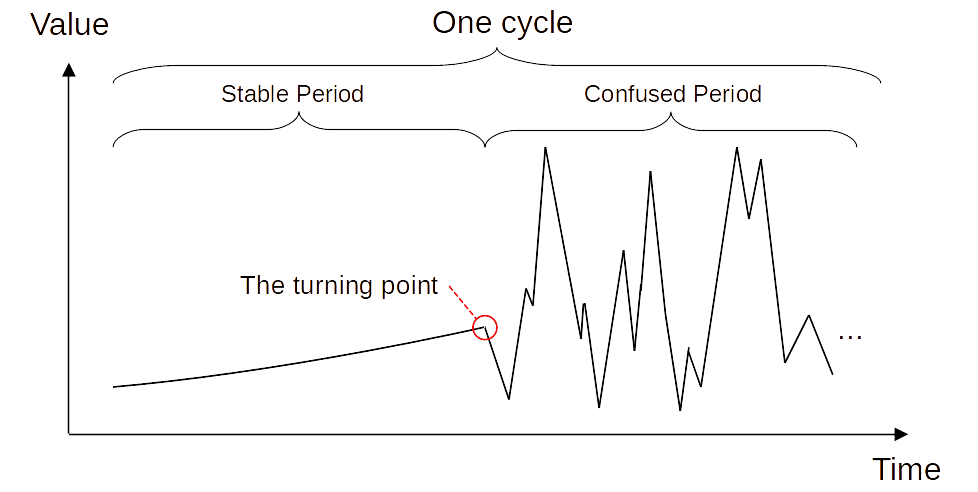

In my case, I like to add another kind of cycle: stable and confused periods, as shown in the following image:

Combining those concepts tells us how the price moves in the financial market. This allows me to understand a cycle in the vague.

Of course, there could be many patterns of combination to understand the duality. We can make it freely based on our senses.

Conclusion

They are the ways to predict the future by knowing the patterns of how crowds react.

Although predicting the future is often hard, some are possible. What the crowd decides could be one of the predictable areas. We can take advantage of it.

This knowledge might allow us to find an opportunity to take advantage of future change.

Thank you for reading this article. I hope to see you in the next one.