Let’s talk about a way of thinking to create assets. Today, I will introduce the concept of a complex system. This way of thinking might allow us to predict the future more easily.

How to predict the future

Sometimes, we want to predict the future to create wealth. If we can do it, we can prepare. That gives us relaxation and reduces our anxieties about the future. In addition, we can use it as an opportunity to increase our assets.

However, predicting the future is sometimes hard because the future often doesn’t go as expected. There are usually many unexpected events. They make us confused about future predictions.

A typical example is our mental state. We often lose control of our minds if we don’t know how to manage them. We sometimes fall into deep depression, no matter how positively we try to think.

Another example is forecasting the price of the financial market. If we begin speculating on stocks or forex in the short term, we will always make losses, even if we make a little profit at first. Prices always follow the opposite of our expectations. We will soon find it hard to make short-term forecasts in the financial market.

How can we handle them?

Today, I will introduce the concept of a complex system. It is a framework to predict the future. It might allow us to create long-term wealth.

What is a complex system?

We can use a complex system to predict the future.

Although there is a scientific definition, I will define it compactly to make it easier to understand: a complex system is a system that arises from the most unexpected events. Our minds and the financial market prices are examples of complex systems.

In other words, we think about the most unexpected things that could happen. That allows us to predict the complex system, including the behavior of our minds or the price changes in the financial markets.

The structure of a complex system

Let’s look at the structure of a complex system. I will use a simple model of a complex system here.

The complex system determines a value by two components interacting with each other.

For example, we have positive and negative minds. Those two factors determine our current mood. In the financial market example, people’s emotions and logical sense affect the price.

The relationship between the two factors

The simple symbol of the relationship between the two factors is yin and yang, the concept used in Taoism (Daoism).

Yin is the dark part. Yang is the bright one. They are two in one. We cannot separate them. Yin and yang are not completely dark or bright. They contain the opposite sides of elements. The light part could be dark from another perspective. The dark one could be light from another perspective. In addition, they affect each other.

For example, our minds are composed of positive and negative parts. A positive attitude will be negative from another perspective. Positive activity, such as working, creates wealth but makes us tired. Negativity, such as rest, prevents creating wealth but makes us healthy. Our positive mind affects our negative mind. We cannot decide which is positive or negative.

In the financial market example, people’s emotions and logical sense determine the price. People often judge based on rationality. They buy cheap assets that will be profitable. However, they often judge irrationally. They don’t want a loss. They fear a loss. That makes them sell it due to their fear when the price continues to fall, even if it is an opportunity to buy in the long term.

We don’t know what is positive or negative. We cannot say whether we are rational or irrational. Those two factors determine our current state or the financial market price.

The cycle of a complex system

A complex system has another aspect: time. That allows us to recognize the whole picture of the complex system and predict it in the long term.

The longer we look at it, the more predictable the cycle is.

An example of the mental cycle

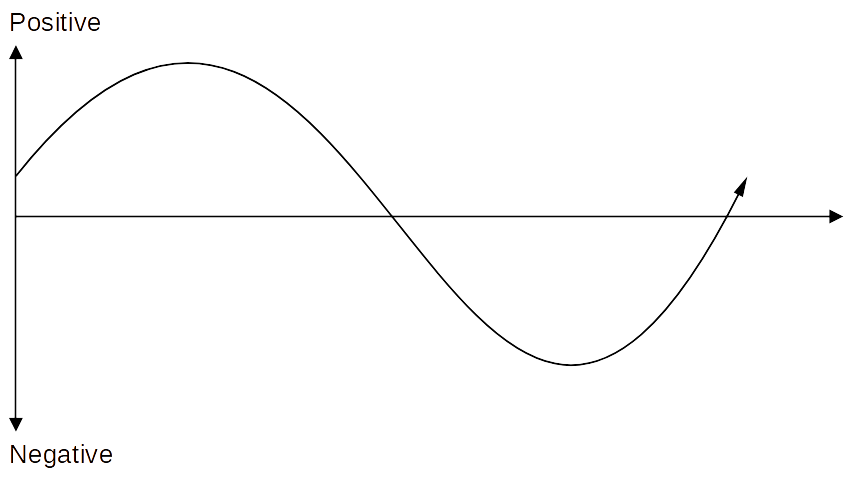

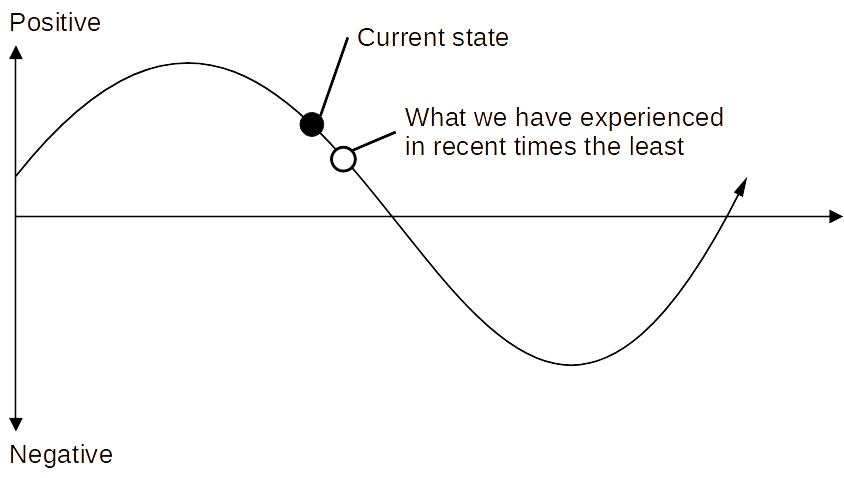

The following image is an example of our mental state:

We have positive and negative waves. We can find these waves in any period: the long term, the medium term, and the short term.

Usually, the amount of positive and negative activity is almost the same because we cannot say which is positive or negative.

However, we can predict the cycle. For example, we are active during the day and rest at night. We might be active when we are young and relax after old age.

We can feel those changes according to the phases of our lives.

An example of the financial market price

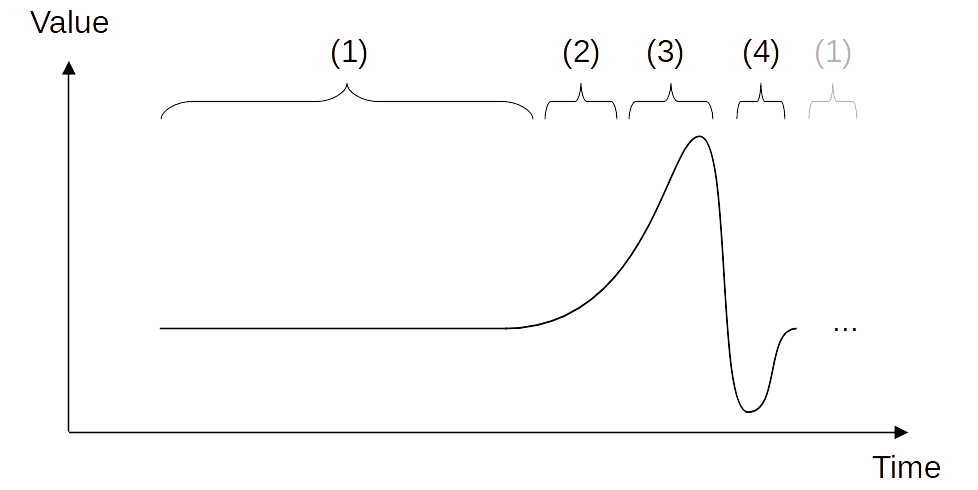

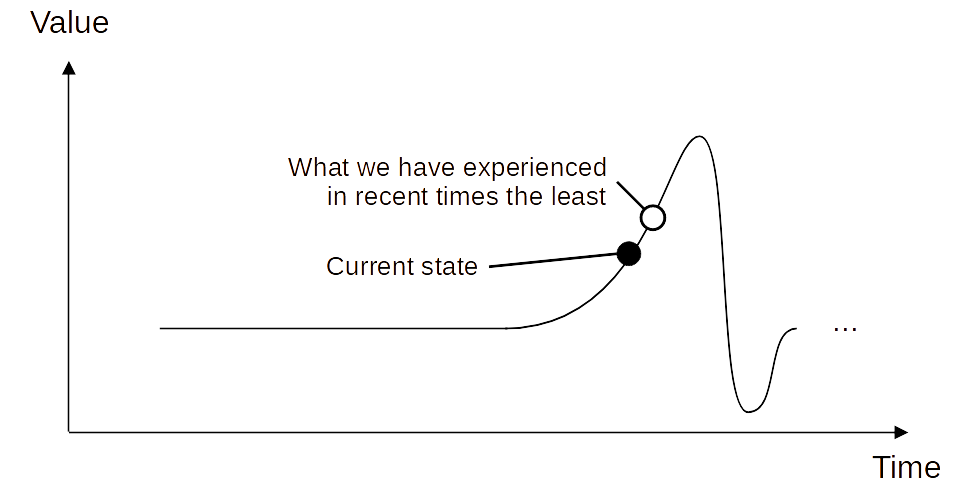

The following image is an example of the financial market price cycle:

Those waves happen in any period: the short term, the medium term, and the long term. These waves overlap to form one big wave.

The longest-term perspective allows us to understand the price movement.

The logic we fail to predict the future

People who cannot handle complex systems make decisions based only on the most recent tendencies.

For example, assume we are people who cannot manage our minds. In that case, we tend to judge only the most recent activities. If we were excited about something yesterday and want excitement today, we try to do the same as yesterday.

However, we cannot keep feeling excited because we get gradually bored. The positive mind strengthens the negative side, but we don’t know the facts. We try to feel the excitement again and again. That accelerates the boredom. That causes us unexpected negativity. We may say, “Why cannot I be positive, even though I could do it until yesterday?”

That is why the more we stick to a positive mindset, the deeper we will fall into unwanted depression.

Even if we endure with patience in the short term, the unexpected waves of the longer term will come. They beat us down.

The typical failure of dealing in the financial market

In an example of financial market failure, we might believe one side of two elements: people’s emotions and logical sense.

If we lean toward the emotional side, we will feel that “people’s minds determine the price.” That makes us try to buy and sell based on psychology.

On the other hand, if we lean toward the rational side, we feel that “I should have solid logic.” That makes us try many indicators.

Then, we try to find efficient methods based on those aspects.

However, we will lose as long as we stick to the most recent price movements. The phases alter. That causes unexpected losses.

That is why we make losses in complex systems.

Recognizing the complex system

Recognizing the whole picture of the complex system tells us how to deal with it.

The longer we look at it, the more predictable the cycle is because it shapes a typical wave. In addition, we can easily find the phase change.

In other words, we first prepare for the most unexpected things when we deal with a complex system, as shown in the following images:

In a complex system, don’t judge the future by the recent past tendency. We judge it by the event that we experienced the least from the longest cycle perspective. That will prevent losses.

Understanding this concept will bring us fantastic profits.

Conclusion

A complex system is a system that arises from the most unexpected things.

It is a framework to predict the future.

That might allow us to create long-term wealth.

Thank you for reading this article. I hope to see you in the next one.