I introduced the investment styles in the previous article (this article). Investment could be one of the ways to create assets for innovative, empathic people. Today, I will talk about the cycle of investment.

How to create more assets

Sometimes, we want to create more assets to make our futures more comfortable or to let go of anxieties for the future.

Assets are things that will give us value in the future. For example, skills, knowledge, experiences, wisdom, businesses, real estate, or financial assets could be assets if they grow in the future. Even an orange tree in our yard would be an asset because it gives us fruits every year.

Investment is one way to create assets. It is an activity that takes advantage of the time difference. Something is worthless now, but it could be valuable in the future. We predict it, get it, and store it. After it becomes expensive, we consume it or sell it.

That is why the concept of time is essential to investment. That allows us to predict the future. The idea of a cycle is one form of it.

However, we sometimes don’t know how to find good opportunities. We know neither what to buy nor when to buy it. That often makes us feel that investing is difficult. Sometimes, it might drive us to speculate, like gambling.

Today, I will introduce an example to help understand the concept of a cycle of investment for innovative, empathic people. This knowledge might tell us how to find opportunities to invest.

The four types of personalities

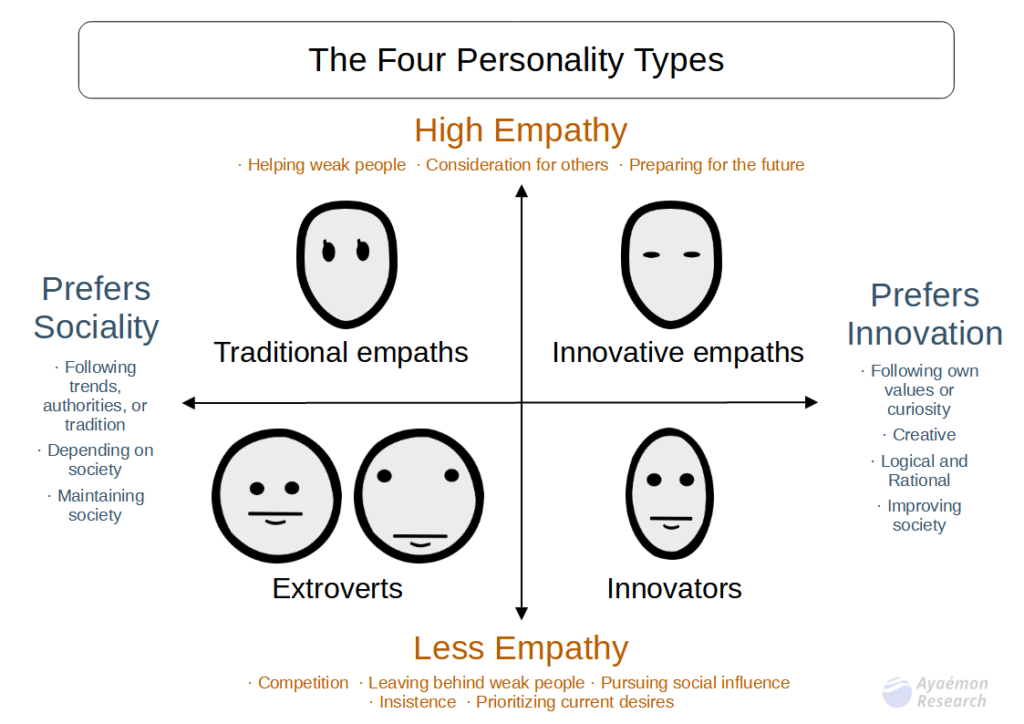

To explain it, let me introduce the four types of personalities that I often use, as shown in the following image:

Explanation of each personality

We classify our personalities into four types. I will explain them from the perspective of investment, as follows:

- Extroverts: They are the least suitable for investment. They prioritize the short-term gain over the long-term. In addition, they cannot understand market logic or cycles. That makes them follow trendy investments. They create a big trend. Then, they lose money when the market crashes.

- Traditional empaths: They like long-term investments with stable methods. They can operate well during stable periods. However, they cannot understand market logic or cycles. That causes them to make big losses when the market collapses. Sometimes, they act as extroverts during a stable period and follow the trends.

- Innovative empaths: They are the most suitable for investment. They can keep their assets in a stable period. They can increase their wealth dramatically during the market crash because they can understand the cycles of the markets and take advantage of them.

- Innovators: They like short-term speculation. They can understand the logic of the market but don’t have the mental power to wait. That causes them extreme profits and losses at any time, like gambling. Their successful sides will often be ideal for extroverts. That leads to new trends.

Perhaps this blog’s readers tend to be innovative empaths, so assume we are innovative empaths in this article.

A cycle of a super-long-term investment

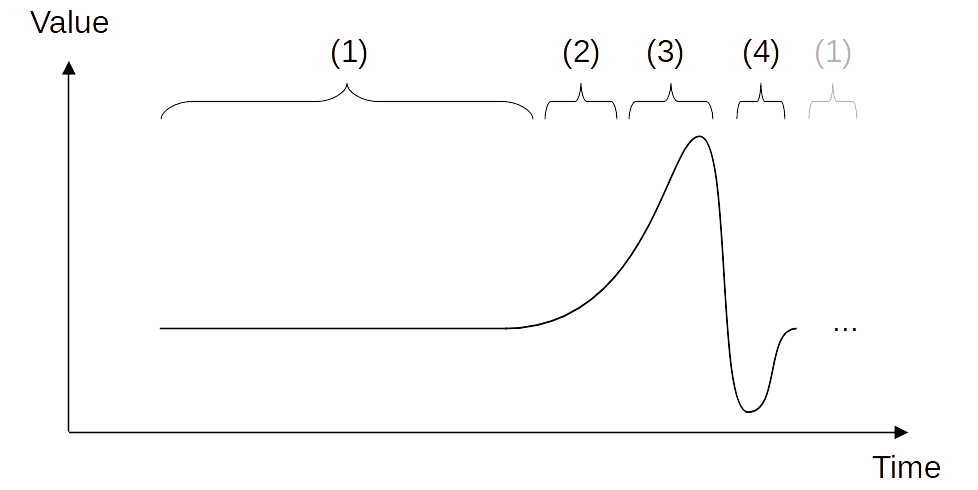

Let’s look at an example of the cycle in super-long-term investments. A super-long-term investment would be the most suitable way for us. Let me show one of the typical cycles as follows:

There are four stages.

- Stage 1: Out of season

- Stage 2: The beginning of the rise

- Stage 3: The bubble period

- Stage 4: The collapse

Let’s see each stage. I will explain with an example of Christmas goods.

Stage 1: Out of season

The first is the out-of-season stage. This period tends to be longer. The price tends to be cheaper, but the number of transactions is low. Despite its relative inexpensiveness, most people are not interested in it because it is out of trend.

Assume that we want to buy Christmas goods. We want to consume or sell them next Christmas.

In this case, from the new year until the summer would be this stage. Although they are not the cheapest and there are not enough supplies, we can buy them little by little. We have to wait patiently at this stage.

Stage 2: The beginning of the rise

The second stage is the one in which the price begins to rise. Successful innovators start to emerge. That makes people pay attention to it, little by little.

In the example of Christmas goods, autumn would be this stage. We stop buying them because they are no longer affordable. We start focusing on when to sell them.

Stage 3: The bubble period

The third stage is the stage of the peak period. It forms a trend.

Many people, mainly extroverts, want and rush to buy them because they are valuable. They believe those valuable things give them higher status. They want to stand out by getting something that people value. In addition, they also expect that the prices will keep rising forever. Many extroverts buy them to satisfy their greed.

In the example of Christmas goods, it will be the early winter. It is time to sell and leave. We let go of it when many people want it. That is our style.

Stage 4: The collapse

The last stage is the one in which the price collapses. Many people don’t want it or cannot afford it anymore. That causes the price to crash. (I will explain this market logic at some point.)

In the example of Christmas goods, it would be just after Christmas or even several days before. It is the best time to buy. There are so many discounted goods.

At this stage in the financial market, many people rush to sell because they don’t want to make more losses. We buy when many are selling crazy.

Integrating with our personalities

If we understand that cycle, we can use our personality efficiently. We are not good at being part of crowds. We feel anxious when we have the same values as the majority. Those natures give us wealth in investments. We can take advantage of such a personality as a precious talent.

That concept of the cycle tells us that it is risky to buy assets that have already begun to rise. This is because its price could fall. We want to avoid losses rather than making profits with the risk of a life breakdown. As a result, we buy assets cheaply and sell them for a high price. We can keep holding if we get dividends, such as an orange tree in our garden.

On the other hand, many people buy assets at a high price during the boom and sell them at a low price during the market crash.

That is the style of a super-long-term investment without losses.

An example of avoiding the trends

Perhaps that is why investors with that style don’t buy new trending assets that have just come out recently. For example, Warren Buffett or Jim Rogers have not bought Bitcoin or other cryptocurrencies. That is because we cannot predict the cycle. It is hard to foresee how much is affordable.

However, we can buy it once we know the cycle and the right price.

For example, Warren Buffet bought the stock of Apple after the market crash in 2007. Apple was one of the most trending IT companies in the 2000s, but he never bought it before the market crash. Many analysts said, “He became outdated. He cannot understand the value of IT companies.”

However, he made a big profit as a result. He could wait even with such ridicule because he knew it was during (2) the beginning of the rise to (3) the bubble period. On the other hand, those who ridiculed him did not leave their names. Perhaps they lost their money.

Recently, it happened again in cryptocurrencies. They said, “Warren Buffet became outdated. He cannot understand the value of Bitcoin.” Then, history might repeat itself, although I don’t know whether he will buy them, even if they are almost zero in price.

The potential of super-long-term investment

Perhaps this is the power of super-long-term investment that suits innovative empaths. We can predict the logic of the market. We also have the mental patience to wait. If we use those personalities as a talent, they might bring us a comfortable future.

We don’t have to worry about being left behind by trends, especially in investments. Understanding the market cycle gives us the judgment and patience to wait to invest.

Conclusion

That is an example of a cycle for investment. Perhaps that will be one efficient way to create assets for innovative empaths.

This knowledge might tell us how to find opportunities to invest.

Thank you for reading this article. I hope to see you in the next one.