Let’s move on to another topic. Today, I will introduce my ideal investment style for innovative, empathic people.

How to be more abundant

Sometimes, we want to manage our assets efficiently to be more abundant. Perhaps we all have to depend on society more or less, no matter how we like independence.

Our assets give us safety for the future. Assets include not only money but also various possibilities for the future. Even a planter to grow vegetables can be an asset because it will bring us value for the future.

That is why we want long-term asset management. We want to make our futures comfortable.

However, we often don’t know how to do it. There are many ways to manage assets, such as financial planning, trading stocks, investing in real estate, or investing in dividends. Those complex and unfamiliar things make us confused.

Today, I will explain an investment style that may suit this blog’s readers, innovative and empathic people. Perhaps a super-long-term investment without making a loss will be the best.

The four types of personalities

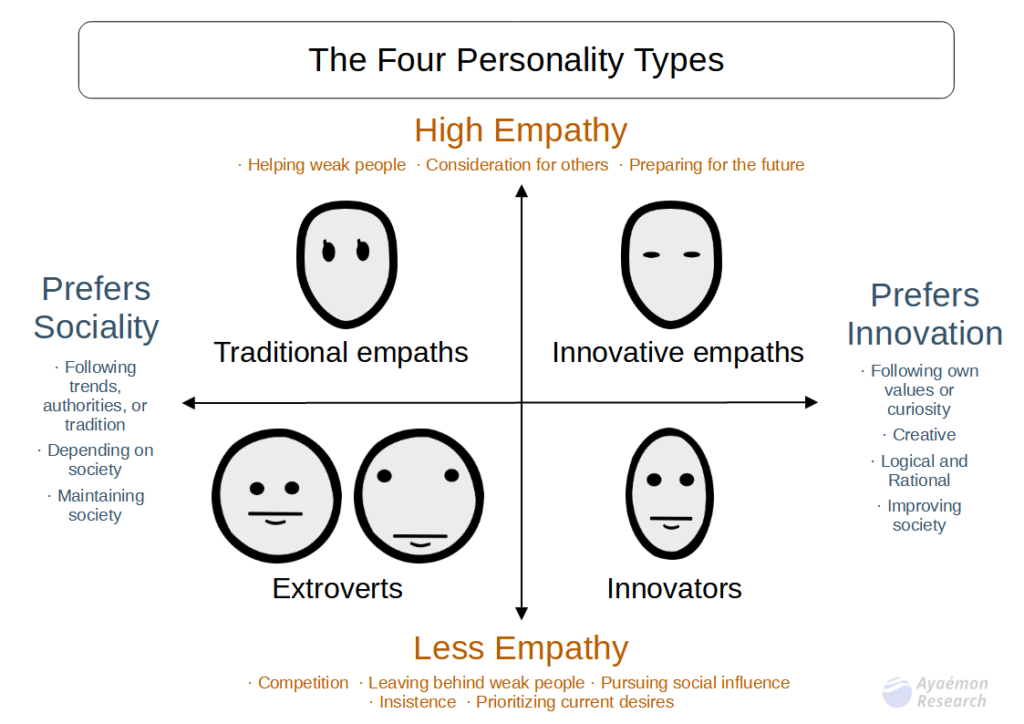

To explain the logic, let’s see the four types of personalities that we often use, as shown in the following image (I added a little modification.):

An explanation of each personality

We classify our personalities into four types as follows:

- Extroverts: They are the people with the least suitable personality for investment. They tend to spend as much money as they have and want short-term gain due to less empathy. In addition, they can neither understand the market logic nor foresee the recession. That makes them imitate the people who made money instantly. They create market trends and lose their assets when the market crashes or goes into recession.

- Traditional empaths: They tend to want to manage their assets. They prefer avoiding decreasing to increasing. However, they can neither understand the market logic nor foresee the recession. That makes them rely on methods that can be used for as long as possible, such as financial planning or diversification.

- Innovative empaths: They are the most suitable personality for investment. They tend to want to manage their assets. They prefer avoiding decreasing to increasing. In addition, they can understand market cycles. That makes them prefer investing in the super long term without losing.

- Innovators: They tend to spend as much money as they have and want short-term gain due to less empathy. However, they can understand market logic. That makes them prefer short-term trades. Their style is like gambling or speculation. They sometimes gain big, but sometimes lose big.

Let’s explain more deeply.

Empathy creates the need for asset management

Asset management is for those with high empathy.

Empathy makes us worry about the future because empathy is the emotional feedback of our imagination. We feel fear when we think about our miserable future, even though it is our imagination. We empathize with the emotions of the future.

In other words, empathy gives us patience for the future, including the ability to wait.

That makes us prioritize the safety of the future over the pleasure of the present. Empathy allows us to prepare for the future.

We, empathic people, prefer avoiding losses to making profits because safety means preventing critical situations. It is okay if only we can maintain the current level, even if it doesn’t increase. We want to stay alive as comfortably as possible rather than become rich with the risk of a breakdown of life.

That is why asset management is for those with high empathy. It is to prevent critical situations in the future. Increasing assets is not the primary goal.

The nature of less empathic people

On the other hand, less empathic people cannot feel fear for the future. That makes them prioritize their desires in the present, even if they can predict the future.

For example, some say and decline when a friend invites him to play,

“I cannot afford it. I spent too much this month. I don’t have any more money. I have to live on another $5 for the next two weeks, until the next payday.”

You might have heard such conversations.

It is unbelievable for highly empathic people because we cannot help but worry about the future. In other words, less empathy makes living easy without worrying about the future, but it can be fatal when a crisis comes.

Market logic tells us how to invest

Understanding the market logic based on empathy allows us to invest well.

An example would make it easier to understand.

Assume it is the end of the Christmas season. There are discounted Christmas goods in grocery stores. Some are half-price or 80 percent discounts.

We can buy them now and store them until next Christmas if we use them next Christmas. We can save money. Perhaps we could make money if we could sell it individually in the next Christmas season.

An example of a market logic

On the other hand, those grocery stores cannot store them because they don’t have enough room in their warehouses. They want to use their warehouses for next season’s goods to maximize profits. That creates a discount for a certain period.

That is an example of market logic. There is a cycle in the economy. They have no choice but to sell it, even if it is discounted.

On the other hand, we can buy discounted assets during such a period. We can store them and wait for next Christmas. It is an advantage for us.

We can predict when it will be the cheapest. One of the examples is the market crash. We understand we will lose very little if we buy during that period. In addition, we can foresee that Christmas will come again next winter. That allows us to invest safely without making a loss. Sometimes, we can profit big if we can sell them appropriately next winter, but it is incidental.

That is why I like the financial market. There is logic and a cycle. We can sell the assets that we bought. The cost is to wait for the next season. Our empathy allows us to be patient with the future. Our logic of the market cycle and empathy give us the talent to invest in the super long term without making losses.

The investment style for innovative empaths

That is why investment in the super long term without losing suits us, innovative empaths. We can understand the logic and cycle of the economy. In addition, we can wait.

That allows us to understand that the style of Warren Buffett, one of the most famous investors, is for those with innovative empaths.

For example, his teachings on investing are as follows:

- “Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1.”

- “Be fearful when others are greedy and greedy when others are fearful.”

- “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

- “Price is what you pay. Value is what you get.”

We can understand them clearly.

The talents of innovative empaths

Perhaps we naturally consider the rarest and most critical risks, such as market crashes or recessions, to prevent losses if we are innovative empaths. That is why we and many fund managers can create assets during a market collapse. It is because we can buy them the cheapest.

Although it is hard to create numerous profits in the short term like innovators in the stable period, it is okay because we can live frugally.

On the other hand, learning financial planning or trading in the short term won’t help us much. They are useful, but they won’t be our main style. They don’t suit our personalities.

Stable hedge fund managers often have the personality of innovative empaths. It is no wonder. Innovative empaths are ideal for super-long-term investment while preventing losses.

Conclusion

That is why a super-long-term investment without making a loss would be the best for innovative empaths.

We could use these investment ideas in many ways, even if not in the financial market.

This wisdom might give us ideas on how to invest.

Thank you for reading this article. I hope to see you in the next one.