I mentioned a future vision about where to earn money in the previous article (this article). Fortunately, now I can live on a passive income that I had created in the past.

Today, I will talk about a place to make money for those who want to live independently in a quiet place.

How to make money for people who want independence and freedom

Sometimes, we want to be distant from society due to our personalities. We might not be good at being part of crowds. We might want to live freely in a quiet place. Or we might want to live as independently as possible.

We need money more or less to create such lives, but we are often not good at earning because we easily feel stressed in social life. Working as part of an organization exhausts us. In addition, we sometimes find it hard to establish a new business. Although we have a good sense of logic, we don’t know how to apply it to make money.

Perhaps money is one of the most troublesome factors for those who want to live independently and freely.

The financial market might be one of the good places to make a profit for them. Today, I will explain why.

Which market to choose

When we make money independently, we usually use markets. Markets allow us to exchange something valuable, such as our products, for cash.

There are many markets. Grocery retailers usually exchange their groceries for cash through their stores. Farmers may earn money in agricultural markets in each region. YouTubers make profits on YouTube. E-book writers make money on Amazon or their website. Street musicians are in the streets with their boxes for tips. Those exchanging places are the markets.

There is no problem if we are good at creating marketplaces or gathering people into our marketplaces. We will make money soon. Perhaps creators who can create something great can easily do it.

However, if we are not good at it, we must choose at least one market.

The benefits of the financial market for logical people like me

The financial market might be an option for logical people like me. The reasons are as follows:

- The financial market is where individuals participate. We don’t have to be employed. We also don’t have to compete with others. An individual’s ability determines earnings, not company size or fame.

- We can use our logical talents. There is logic in the economy and the recession. If we understand it correctly, we can make profits. We can take full responsibility for our logic. In other words, our logical intelligence determines our interests.

- We can participate, even if we live as hermits. We can access the financial market as far as we can connect to the Internet.

- We can make a profit even in a recession. We can make profits in the financial market, even during the recession, because it is the biggest market in the world. When some prices go down, the opposite prices go up. For example, if the value of information goes down, the value of real things, such as gold or silver, will go up.

The personality that suits investments

Perhaps there are suitable personalities and styles to deal with the financial market.

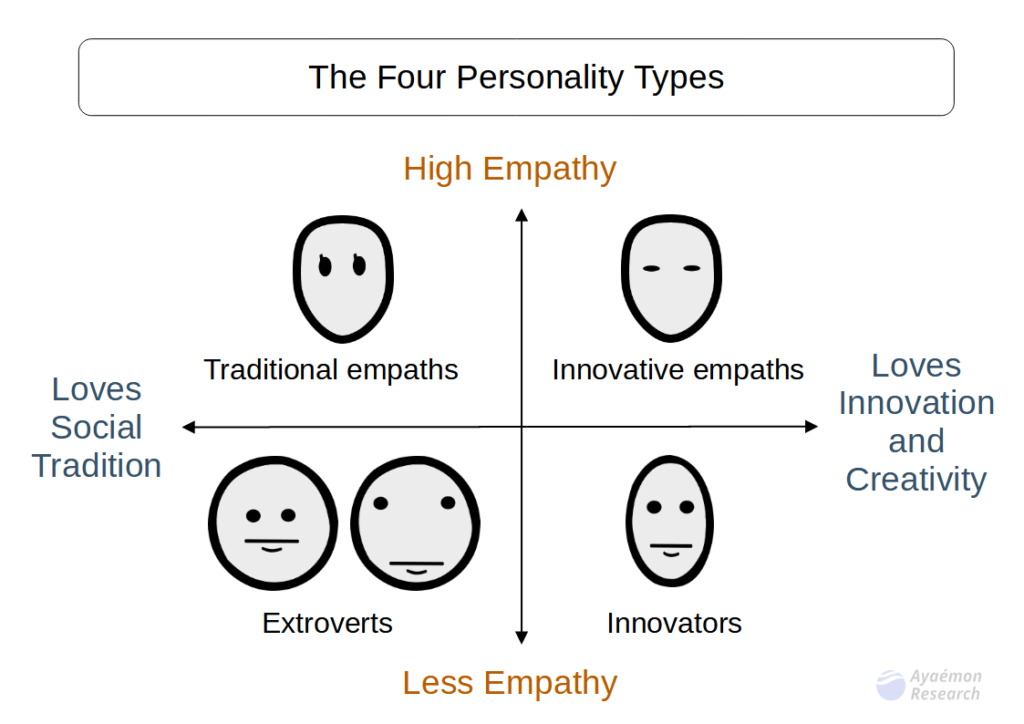

To explain it, we classify our personality into four types, as follows:

We assume there are four types of personalities: extroverts, traditional empaths, innovative empaths, and innovators.

The tendencies of personalities

Each personality has a style that suits them, as follows:

- Extroverts: They are the most unsuitable type of investment because they cannot understand logic and prefer short-term gain. They get few profits during the stable period and big losses when the market collapses. This personality creates trends or bubbles.

- Traditional empaths: Although they do well in the stable period, they tend to make big losses during rare events, such as market crashes. They like diversification because they cannot understand the economic logic but want long-term stability. Financial planners or financial advisers tend to be this type.

- Innovative empaths: They are the most suitable type of investment. They like super-long-term investments based on their logic. In addition, they can wait. That allows them to create wealth during rare events like market crashes. They can increase their wealth dramatically during the recession and keep it during the stable period.

- Innovators: Although they often make big profits due to their logical skills, they also make big losses because they cannot wait. Their style is like gambling or speculation. They like shorter-term trades. People who make big profits in a stable period in the short term tend to have this type.

Innovative empaths are the most suitable personality for investments

Perhaps the personality of the innovative empaths is ideal for investments. This blog’s readers may tend to be this type. We can understand the logic and wait longer. We can invest in many forms, even without the financial market.

If you are interested in investments, try thinking about super-long-term investments. Perhaps it suits us because it is less stressful and we can do trial and error.

On the other hand, short-term trading tends to stress us. In addition, it often causes us to lose our mental balance because we are not good at gambling. It is based on my failure.

Perhaps it will take several years to make a profit. In my case, it took 4 to 5 years. Until then, I had piled up losses. Despite those losses, I could keep progressing because enhancing logical skills was fun. We can feel progress through our experience and feedback with our logical sense.

Who to learn from

Here are three people to learn from.

- Warren Buffett: His style is for innovative empaths leaning towards innovators.

- Jim Rogers: His style is for standard innovative empaths.

- Ray Dalio: His style is for innovative empaths leaning towards traditional empaths.

Their ways of thinking will help you if you want to learn investment logic. Hedge fund managers tend to be innovative empaths.

I like Jim Rogers, although I like Warren Buffett and Ray Dalio. Perhaps my style is the same as Jim Rogers’s because his reasoning and mine are the same.

Perhaps the more we think for ourselves, the better results we will have in the financial markets. Although we will make a loss at the beginning and it will take several years to make profits, we can improve little by little.

Conclusion

If we want to live independently and freely, the financial market might be one of the good places to make a profit.

Although I am still doing trial and error, it might help us to make money to live.

Thank you for reading this article. I hope to see you in the next one.