Recently, I have talked about investment. Investment could be a good way for innovative, empathic people to create material wealth. Today, I will talk about why, from the perspective of our behaviors in extraordinary situations.

How to become materially rich

Sometimes, we want to be materially rich, especially if we cannot live in the same way as our surroundings.

Our minor personalities, such as empathy and logical sense, often prevent us from earning money as employees. We worry too much about the future, even if it is unnecessary. We want to do everything freely and keep improving, although our society doesn’t need change. That makes it hard to find opportunities. That sometimes makes us materially poor.

Although we can live frugally and don’t need many things, we must secure the fundamentals. It will be more important when we try to live in a secluded countryside.

Investment could be a way to create wealth for us because our personalities suit it.

However, we sometimes don’t have confidence. Many say, “Investing is hard for many people” or “Only people with special talents can do it.” We might wonder why we, who cannot even do normal things well, can do something special.

Today, I will explain why our strange personality allows us to make a profit from investing. This logic might give us confidence.

The four types of personalities

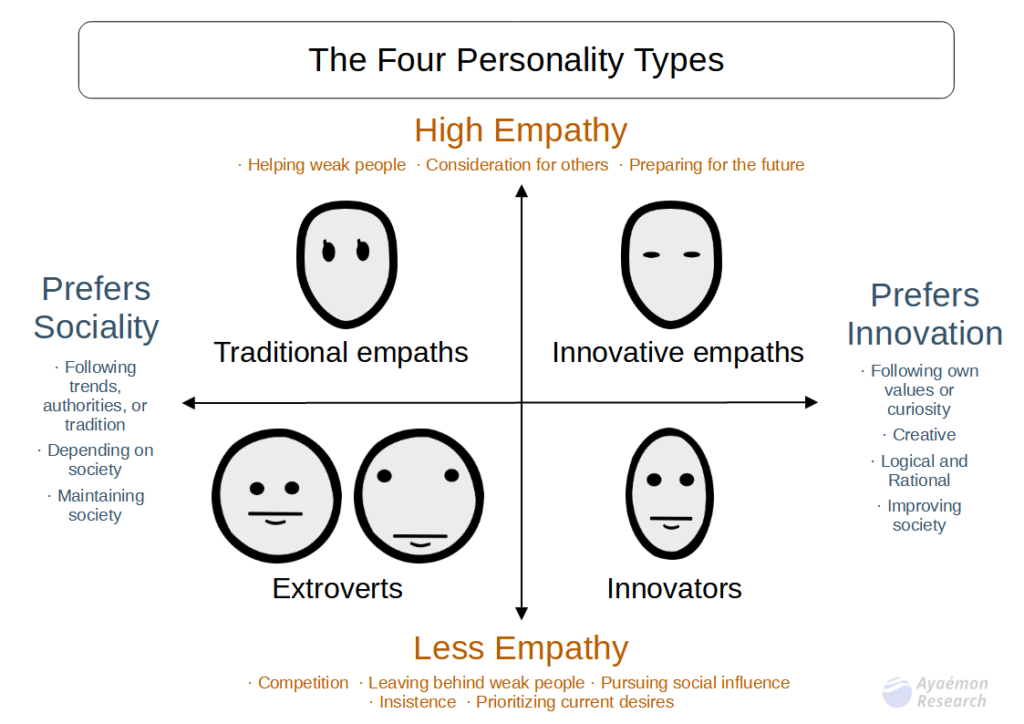

To explain the logic, I introduce the four types of personalities I frequently use, as shown in the following image:

We classify our personalities by two axes. One axis is highly or less empathic. The other is whether they prefer social traditions or innovation.

The four senses

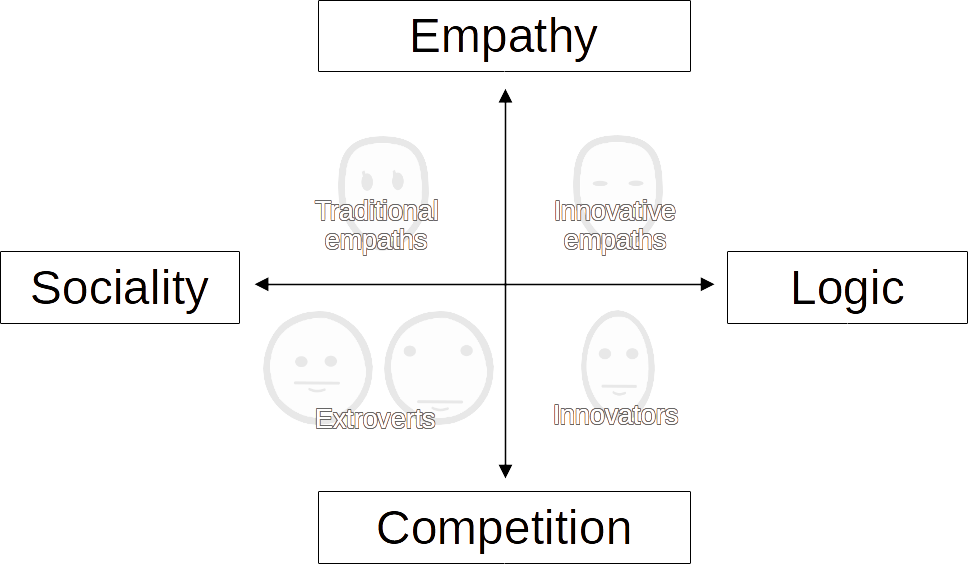

In other words, we could have four kinds of sense: competition, sociality, empathy, and logic. Their relationship is shown in the following image:

The senses in ordinary and extraordinary situations

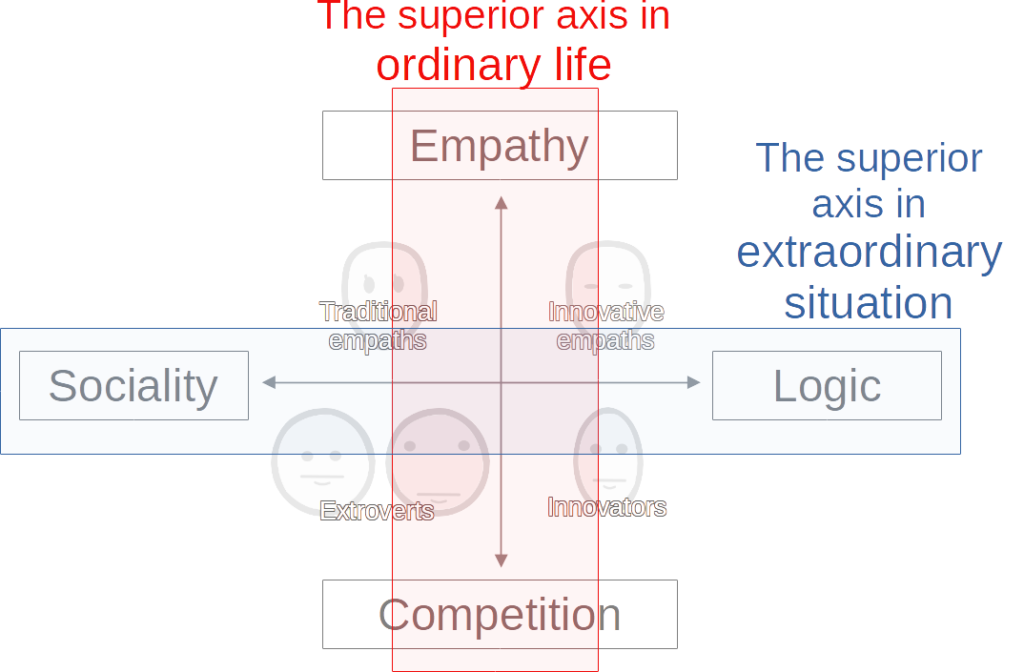

We can divide those senses into those that are superior in ordinary life or emergencies, as shown in the following image:

- The senses that are activated in ordinary life are competition and empathy. They create their mental wealth.

- The senses that are activated in extraordinary situations are sociality and logic. They create physical wealth.

The four types of personalities

We can classify our personalities into four types, as follows:

- Extroverts: They act in the same way as their surroundings in extraordinary situations. That makes them buy greedily when many people buy and sell when many sell.

- Traditional empaths: (Not in use this time)

- Innovative empaths: They become more logical in extraordinary situations. That makes them judge calmly when many people rush to buy or sell.

- Innovators: (Not in use this time)

In this article, assume we are innovative empaths. Let me explain why we can invest well based on those tendencies.

The senses affected by the situations

Our primary sense changes depending on the situation. If we are innovative empaths, empathy tends to predominate in a stable situation, and logic predominates in an extraordinary one.

Perhaps this is because it is more socially efficient. Logic is a way to change something. An emergency is a situation in which we must change something. On the other hand, empathy is a way to stabilize. The ordinary is a situation where things need to be settled as usual. That is why we often suffer from too much empathy in a stable society.

In investment, the greatest opportunity comes in an emergency or extraordinary situation. In such a case, innovative empaths are the best type to act calmly without disturbing society.

For example, imagine a situation in which many people are panicked by the financial market crash. Many people are in turmoil. However, that social confusion makes us calm down. We can concentrate on what is happening and how to deal with it logically. That is one of the tendencies of innovative empaths.

The reason why extroverts end up failing in investments

On the other hand, extroverts tend to unite at an extraordinary time. Their sociality makes them so. That makes their investment fail.

Social unity is a way to change something without logical sense. It is efficient when using traditional solutions that require manpower. They become enthusiastic when they feel connected to their society. It is a tactic to survive. It is not about which is better.

However, investing works negatively for extroverts and positively for innovative empaths.

For example, there is an overheated economy called the bubble economy. It is an extraordinary economic situation.

In such a situation, extroverts are naturally united with their society, including social media or SNSs. That makes them buy at even the highest prices, like their surroundings.

It is the same when the market crashes. It is an extraordinary situation, and many people are selling. That makes people rush to sell, even at the lowest price. That is their nature.

Activities that suit our personalities

On the other hand, innovative empaths can naturally invest well due to their personality. While people rush to buy or sell in an extraordinary situation, we can deal with calm. In other words, when people react emotionally, we naturally judge logically.

In a stable period, we can naturally deal with emotions. We don’t want to compete with others. We are not good at crowds and trending things. That allows us to find hidden gems that have not yet become famous. We can discover “happy leftovers.”

Those tendencies suit well for investing, especially for a super-long-term investment.

Thinking as an investment

It is the same in any market, even if we are not in the financial market. Try thinking of our activities as an investment rather than getting paid.

Then, try thinking about whether the activity is worth investing in. That will tell us what to stop or start doing from a long-term perspective.

That will give us an independent way to succeed.

Conclusion

That is why our strange personality allows us to make profits in investing.

Although we are not good at getting paid as employees, we have the talent to invest.

That might give us an independent way to succeed.

Thank you for reading this article. I hope to see you in the next one.