These years, I finally came to understand the essence of investment. Today, I will talk about why scientific thinking cannot generate sustainable investment profits.

How to make continuous profits by investing

Sometimes, we want to make money with our talents. Doing what only we can do gives us fulfillment. If we can make money through that activity, it would be great.

If we are empathic and creative, investing could be an activity that suits us to make money while showing our talents. Empathy allows us to prepare for the future while avoiding speculation or gambling. Creativity gives us the ability to find profitable assets. Those natures bring us benefits and fulfillment.

However, we sometimes lose money in the early investment stages due to not knowing its essence.

I used to be in such a situation. When I first started investing, I lost money many times. It was for the first 5–6 years.

Then, I finally understood its essence. Investing is a philosophy, not a science. This knowledge might allow us to make continuous profits by investing.

The four types of personalities

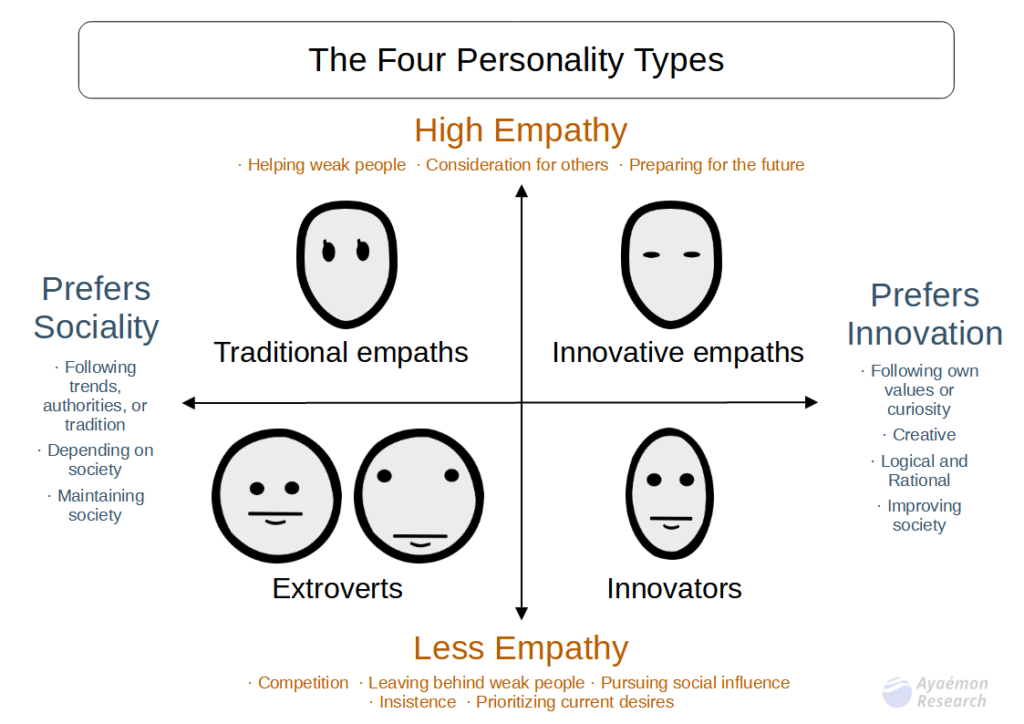

To explain that, I introduce the four types of personalities, as shown in the following image:

We classify our personalities by two axes: empathy and creativity.

The explanation of each personality

There are four personality types, as follows:

- Extroverts: They are not good at scientific or spiritual thinking. They are the least suitable for investment.

- Traditional empaths: They are good at spiritual thinking but not scientific thinking.

- Innovative empaths: They are good at spiritual and scientific thinking. In other words, they are philosophical. That makes them the most suitable for investing.

- Innovators: They are good at scientific thinking but not spiritual thinking.

Assume we are innovative empaths in this article.

Investment as a philosophy

Many people think investment and the economy are science. However, that is wrong, in my opinion. To be precise, that is not accurate.

Investment requires a philosophy. Philosophy is the activity of searching for an appropriate answer between science and our spirits. Without both of them, we cannot make sustainable profits in investment.

In other words, neither science nor spiritual activity alone allows us to succeed in investing.

Science and spirituality that create our lives

Science and spirituality create our lives, although they are incompatible.

This means that all human activities have at least two contradictory aspects. Sometimes, we make decisions based on our spirituality. However, we sometimes judge according to scientific thinking. Human beings are rational and irrational. Something right in spirituality can be absurd in science, and vice versa. There is no clear answer.

For example, when we were students, we might have struggled with our career paths. Probably we didn’t decide them based on only science because our lives are not science. We are spiritual beings. We want to live our lives.

However, at the same time, we might have considered which way is better logically. We might have compared which company provides us with a better salary. Such logical thinking is a part of scientific thinking.

We are living in such a way between science and spirituality. We are not simple.

Comparing philosophy with religions and science

Although religions and science are contradictory, both give us clear answers based on each perspective.

Religions teach us the right answer to live spiritually. The Ten Commandments by Moses is one of the examples. Those teachings are not scientific. They are spiritual orders. However, it has become the basis of modern laws in Western countries. It means politics and social life are not sciences.

However, religion alone didn’t progress human beings. Science also made us enrich ourselves. Now, we can get a lot of information from smartphones thanks to advances in science.

Religions and science both give us clear, right answers. However, they are incompatible. Religions ignore science. Science disregards spirituality.

Philosophy that integrates spirituality and science

Philosophy is about considering both together. We think logically about something that has a spiritual aspect. That is why there is no right answer in philosophy.

For example, in philosophy, we ask unanswered questions, as follows:

- “What do we live for?”

- “Why is the world shaped like this?”

- “Why do I exist?”

- “What is existence?”

Predicting the unknown future is similar to them.

Traditional empaths prefer religious thinking. Innovators are good at scientific thinking. However, they cannot consider them together because religion and science are incompatible.

They cannot walk a path without ‘right’ answers because having no answers makes them anxious.

However, innovative empaths can live in such a way. They are good at going down a path with no right answer because they are philosophical. In other words, we can accept the chaos.

To prevent mistakes in the early investment stages

Investing requires philosophy. Investment has chaos. We have to predict the unknown future.

In the financial market, the economy looks scientific, but human lives are based on spirituality. It means that spirituality also affects the economy.

When we first start investing in the financial market, we often try to judge only based on a scientific aspect. The typical examples are finding the ideal indicators, trading methods, or efficient AI. However, they will make us lose money in the end because they are scientific approaches.

We can learn why LTCM, the investment company created by Nobel Prize winners, broke. They are only based on a scientific approach.

We have to think about it philosophically.

Why we need a super-long-term perspective

Philosophical thinking makes us think from a super-long-term perspective. We assume investment is a part of the universe, although it seems a bit exaggerated.

There are universal laws of nature. For example, everything that is alive will die someday. That would be one of the universal laws.

That indicates that no stock continues to rise. We can understand that the teaching ‘the S&P500 continues to rise’ would be false because the Earth’s life is finite. Perhaps the S&P500 would not outlive the Earth, although humans might be able to migrate to another planet in the future.

In other words, in investment, we have to take a longer-term view and make a decision. Judging by recent trends will make us lose money in the end. That is a part of philosophical thinking.

In the early investment stages, we tend to approach the financial market with scientific thinking because the prices come out in numbers. However, we have to know the market is based on human lives, which is also founded on spiritual human lives.

That is why investing suits innovative empaths, but it is hard for many people. We can endure such chaos thanks to our philosophy.

Conclusion

That is the essence of investment, in my opinion.

Investing is a philosophy, not a science.

This knowledge might allow us to prevent losses in the early stages and make sustainable profits by investing.

Thank you for reading this article. I hope to see you in the next one.